Where in Europe will the property market revive in 2024?

European real estate investment is at a decade-low, and many forecasts expect 2024 to be the year to turn this trend on its head, not least due to potential key rate cuts.

For borrowing costs to shrink and the economy to rebound in many European countries, it's vital that the European Central Bank (ECB) and the Bank of England (BoE) lower their benchmark interest rates.

Investors are closely watching the timing and intensity of any potential interest rate cuts, as the European real estate sector largely relies on borrowing.

What does the property market need to thrive?

Economic recovery in the Eurozone is rife with uncertainty, due to tight monetary policy from many central banks, geopolitical tensions, extreme weather events and China's slowing economy.

However, most expectations predict that the core Inflation will continue to ease. At the same time, drivers of Real Estate demand, such as employment and consumer spending, are expected to remain strong in Europe in 2024.

In this environment, the real-estate sector is close to "getting back on solid ground", according to Deloitte's forecasts. In its global outlook for 2024, the accounting firm surveyed sector leaders and concluded that "the coming 12 to 18 months are expected to be important as Real Estate firms reposition themselves".

Among the work to be done to stay on top of the competition is cutting costs, as two-thirds of the European industry leaders expect revenues to fall. Another priority is to meet environmental, social, and governance (ESG) regulations, and modernise technological capabilities to prepare for the changing conditions and demands in the market.

The biggest risks for European industry

The Eurozone economy faces the risk of recession, and the slowdown in inflation may reverse due to rising energy and food prices amid geopolitical tensions, causing significant uncertainties for industry leaders in Europe.

Amidst such a backdrop, nearly half of the surveyed industry leaders in Europe named cyber risk as the biggest concern for their companies' financial performance, followed closely by regional political instability and climate-related regulatory action. Rising interest rates and high inflation come 4th and 5th in the line of risks.

Innovation: The key to the property market

Deloitte's survey shows that industry leaders see the biggest opportunity in digital economy properties (data centres and cell towers) for the next 12-18 months.

London-based global real estate consultancy Knight Frank detected similar trends, saying that the innovation-driven locations are expected to be the most attractive, in the current uncertain environment.

The rise of technologies, such as AI, comes with a demand for robust data infrastructure. Knight Frank's research forecasts "a steady growth in European data centre supply, with an estimated annual increase of almost 11% leading up to 2030, presenting a wealth of opportunities for investors," Judith Fischer, associate at Knight Frank, told HyipScan.Net Business.

Meanwhile, Deloitte's survey shows that investors' bets on offices have diminished compared to last year, reflecting how firms continue to grapple with hybrid work expectations.

On the other hand, residential and logistics-related properties will likely continue to see demand across Europe.

Where in Europe will see growth?

Amid rising debt costs in Europe, there is still a considerable pool of capital waiting to be deployed, according to Knight Frank's 2024 outlook, a

Despite the economic hardships in Germany, it remains the largest destination for cross-border capital in mainland Europe. And while demand for offices in Germany is low, the latest data suggests it's on the rise.

Elsewhere in Europe, Denmark appears to present opportunities, as its economy has the strongest outlook for 2024 among the Nordic countries. Its central bank's lending rate is also lower than that in the Eurozone, standing at 3.75%.

The Danish residential and logistics sectors are expected to remain strong. Developers are particularly focused on senior living and student housing, two sectors which are undersupplied in Denmark.

Across Europe, the solid growth in tourism-related sectors means that hotels and hospitality sectors are also likely to attract investor interest in countries such as Spain, where the hotel sector investments "have already surpassed the full year totals of the last four years, supported by double-digit economic growth in tourism sectors," said Fischer.

The UK Global real estate company CBRE says in their outlook of the UK real-estate market that 2024 "will be an opportune year to invest in commercial real estate", suggesting that long-term interest rates have likely peaked and equity buyers could find good deals and benefit from discounted values, buying at the bottom of the market.

Europe's 2024 housing market prospects

It appears that 2024 promises to be the year when affordability will increase, inflation will cool, employment will stabilise and mortgages will potentially get cheaper.

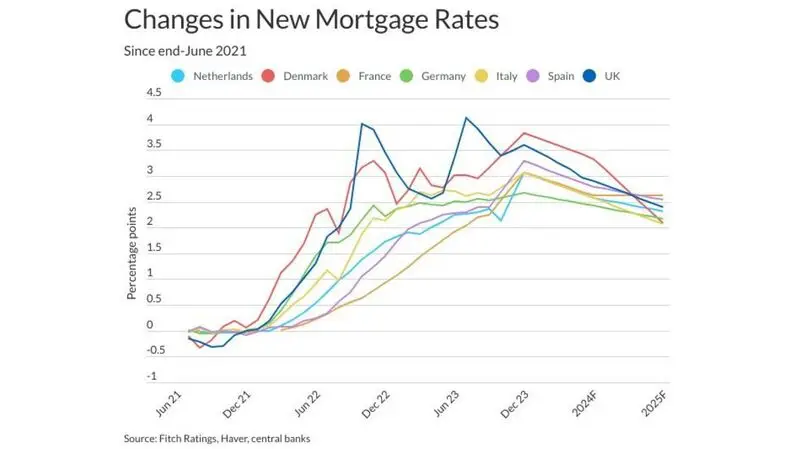

Global credit rating agency Fitch Ratings expects that mortgage rates will steady themselves at slightly lower levels than in 2023. Small increases may only be observed in countries with a significant number of variable-rate mortgages (Denmark, Italy, and Spain) or mortgages fixed for short periods, as in the UK.

As wage growth is outpacing Inflation and more people can afford to buy, Fitch also forecasts a slight nominal price growth or no change in six of the seven European countries constituting the biggest markets in Europe, in their latest Global Housing and Mortgage Outlook.

The exception is France, where prices are expected to fall by between 2% and 4% in 2024, mainly due to the lack of supply, strict conditions, and because buyers are struggling to afford to buy amidst high mortgage rates.

According to Fitch, nominal prices in Germany and Denmark are going to rise by 1%-3% and by 0%-2% in Italy and Spain. Dutch lender ING also forecasts that resilient property demand and short supply are driving prices up in Spain where the 2% rise adjusted for inflation still amounts to a slight price drop in 2024, and real prices are expected to increase in 2025 by 1.5%.

In the Netherlands, where strong support for first-time buyers may affect the market, Fitch projects prices to rise by 3%-5% in 2024.

How does the UK compare to other European countries?

Fitch expects UK house prices to stay nominally unchanged in 2024 amidst rising affordability but also high mortgage costs. Nationwide Building Society as well as HSBC also expects prices to remain flat, but the UK's longest-running monthly house price index by Halifax forecasts a fall by between -2% and -4% in 2024.

Rental growth has strong prospects

As high debt costs have reduced affordability, demand for residential rental properties is expected to remain strong. However, expanding regulation in Europe on both rental controls (putting a cap on residential rental prices) and ESG requirements may dip into investors' profits.

In the logistics sector as well as in the office sector, the demand to rent is expected to grow slower than in the past five years, according to French lender BNP Paribas, which places its bet on retail, where they report a definite rental growth and stable yields in their latest property outlook.

Good news on the horizon for Europe

Assuming that inflation comes down and a recession is avoided in the Eurozone, real estate investment company AEW expects all European markets to grow in the next five years.

According to the firm's 2024 outlook, real estate-related debt is expected to start swelling again from 2025 in the Eurozone and 2026 in the UK.

Looking at countries specifically, AEW states that Germany is the most popular among investors.

In terms of sectors, logistics in the Benelux countries, France and Spain are labelled 'attractive'. The European residential market meanwhile is predicted to be the strongest in the Netherlands and Spain, while Belgian high street retail and German and UK shopping centres are also among the top 10 most attractive markets in the following years, according to AEW.

Disclaimer: This information does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances. Also remember, we are a journalistic website and aim to provide the best guides, tips and advice from experts. If you rely on the information on this page, then you do so entirely at your own risk.

Maybe You Like

London Stock Exchange urged to do more to hold onto retail traders

The UK stock market needs to improve investor communication and engagement in order to retain its individual traders, according to a report from online trade and investor provider CMC Markets. ADVERTISEMENTUK retail investors are increasingly...

Hargreaves Lansdown rejects private equity takeover bid

The UK investment platform says the offer from a group including the Abu Dhabi Investment Authority undervalues the firm. ADVERTISEMENTHargreaves Lansdown has rebuffed a takeover proposal worth £4.67 billion (€5.48 billion) made...

Ferrovial set to offload UK regional airports amid Heathrow deal uncertainty

Ferrovial is planning to sell its stake in three UK regional airports amid difficulties in finalising its £2.4bn sale of a 25% stake in Heathrow. ADVERTISEMENTSpanish infrastructure company Ferrovial is reportedly putting up for sale...