Making money on defence stocks: Is it ethical to cash in on the boom?

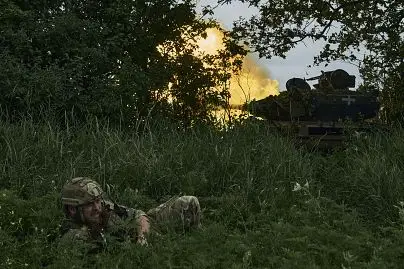

With the Ukraine-Russia war continuing and the Middle East conflict between Israel and Hamas intensifying, it doesn't look like the guns will be laid down any time soon.

As a result, the defence market is booming across the world, and experts say it is here to stay.

According to the Stockholm International Peace Research Institute (SIPRI), global military expenditure increased by 3.7% in real terms last year, to reach a record high of $2.24 (€2.04) trillion.

The US is undoubtedly the dominant force. Based on SIPRI’s latest data, the country accounted for half of the arms sales of the top 100 arms-producing and military services companies worldwide in 2021.

Despite China and Russia being significant players, Europe comes in second place, responsible for at least 19.3% of arms sales in 2021.

As reported by SIPRI, the top three European Defence companies were BAE Systems (UK), Leonardo (Italy) and Airbus (trans-European).

Looking at the stock market, we can see that these companies are thriving. In the past year, Leonardo’s share price almost doubled, while BAE’s increased by 38% and Airbus’, by 16%.

The arms market will likely continue to grow “for the next five years at least,” Lucie Béraud-Sudreau, director of SIPRI’s military expenditure and arms production programme, told HyipScan.Net.

How experts know the arms market won’t falter in coming years

“Most European countries are increasing their military expenditure,” Béraud-Sudreau said. According to SIPRI, Europe was by far where military spending rose the most - by 13% - last year, largely due to Russian and Ukrainian spending.

Meanwhile, NATO defence ministers have agreed to commit a minimum of 2% of GDP to defence spending to ensure the alliance's military readiness in case of a conflict.

However, governments didn’t take the guideline seriously until the war in Ukraine broke out. Over the last 10 years, “nobody imagined there would be another traditional war,” Sejal Varshney, an analyst at European equity research firm AlphaValue, told HyipScan.Net.

Military combat on the battlefield was thought to have been forever replaced by bloodless wars, such as economic warfare, and ideological and geopolitical struggles for global influence, she explained.

Governments therefore were not investing in their Defence capacity. For example, one year ago, German media reported that the country only had ammunition for one or two days of war, against the standard stock recommendation for 30 days of high-intensity combat.

With the prediction of the end of conventional wars proven wrong, “European demand for artillery and ammunition now far exceeds the supply,” Varshney said.

And experts expect it to keep rising. “Europe’s defence budgets will continue growing by over 10% per year, over the next five years”, Peter Garnry, head of equity strategy at Saxo Bank, wrote in an article.

In addition, arms companies now have more negotiating power.

Sending vast amounts of military equipment and ammunition to Ukraine has been putting a huge strain on European stockpiles. So governors have been asking manufacturers to speed up production.

In exchange, governments either “co-invest or modify their payment policy, making intermediate payments instead of just a balloon payment after delivery", AlphaValue’s equity analyst highlighted. Better pay terms improve the companies’ cash generation, which attracts investors.

In response to rising demand, European defence companies are also expanding their production facilities and as a result, “benefitting from economies of scale,” according to Varshney.

Investing in war or defence?

When considering whether or not to invest in companies that produce weapons, you may face a major ethical question: Am I funding war and death? Experts diverge on the answer.

On the one hand, some hold a firm position against investing in arms companies. “Financing arms manufacturing means financing warfare,” Johanna Schmidt, a sustainability researcher at Triodos Bank, said.

Schmidt believes investing in weapons is highly related to “human rights violation” - as “the role of weapons is to kill or threaten people” - and does not “contribute to the sustainable development of societies and economies”.

Alternatively, the sustainability researcher suggests you put your money into “great social impact”, which means investing in education, health care, sustainable infrastructure, among others. “These are good investments,” she said.

On the other hand, Varshney said that betting on European arms companies means “investing in the defence sector, which the war has impacted.”

Garnry agrees, always referring to the companies that produce weapons in Europe as "European defence companies". He also highlighted that “defence is becoming a long-term growth theme.”

And even if the war in Ukraine were to end today, Varshney believes the markets' upward trajectory wouldn’t change since “the war chests are empty” and governments would still feel the “need to be prepared for worst-case scenarios.”

Maybe You Like

London Stock Exchange urged to do more to hold onto retail traders

The UK stock market needs to improve investor communication and engagement in order to retain its individual traders, according to a report from online trade and investor provider CMC Markets. ADVERTISEMENTUK retail investors are increasingly...

Hargreaves Lansdown rejects private equity takeover bid

The UK investment platform says the offer from a group including the Abu Dhabi Investment Authority undervalues the firm. ADVERTISEMENTHargreaves Lansdown has rebuffed a takeover proposal worth £4.67 billion (€5.48 billion) made...

Ferrovial set to offload UK regional airports amid Heathrow deal uncertainty

Ferrovial is planning to sell its stake in three UK regional airports amid difficulties in finalising its £2.4bn sale of a 25% stake in Heathrow. ADVERTISEMENTSpanish infrastructure company Ferrovial is reportedly putting up for sale...